What Startups Got Right About CFOs... and Enterprises Are Just Learning

How startup finance leaders became the blueprint for modern CFOs

For years, I’ve been making the case that your first finance hire shouldn’t just be spreadsheet nerds. They should be your First Operator. Someone who doesn’t just measure the business, but helps run it. Someone who doesn’t wait to be asked, but proactively identifies opportunities to grow revenue, reduce costs, and make the company better.

Lately, I’ve been seeing this exact same model play out at scale. At a recent a16z event for finance leaders, one of the partners made a comment on stage that stuck with me: "The CFO is becoming the CXO."

It’s true. And it’s not just happening at startups. It’s happening at $100M+ revenue businesses. What used to be a high-leverage hire in the early days is now becoming the expectation for late-stage and even public company CFOs. And that shift tells us a lot about where the role is headed.

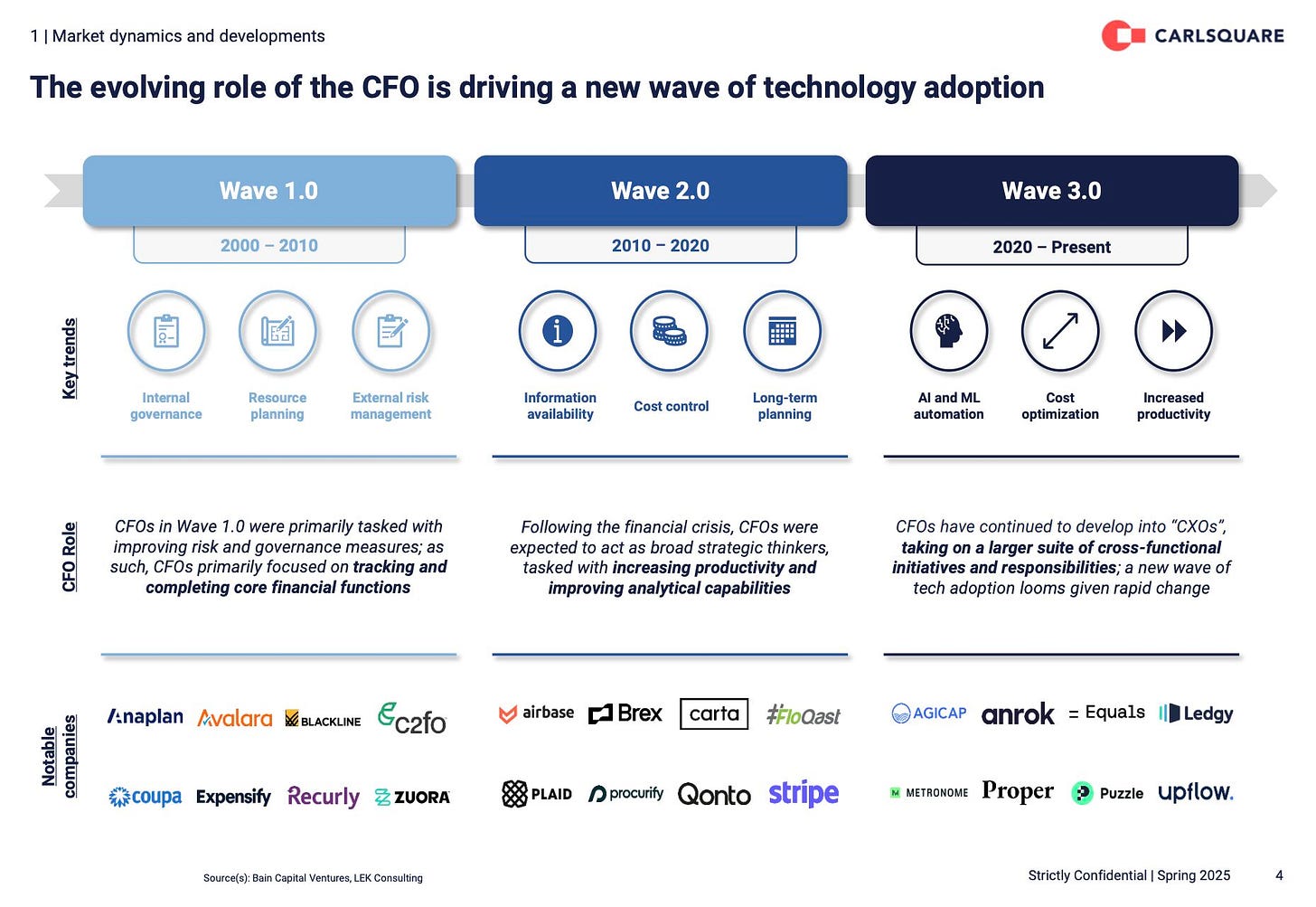

A recent Carlsquare report breaks the CFO’s evolution into three waves.

Wave 1.0 (2000 to 2010): CFOs were primarily responsible for internal governance, risk management, and closing the books. Most came from accounting backgrounds and focused on accurate reporting and compliance.

Wave 2.0 (2010 to 2020): After the financial crisis, the CFO role expanded into strategy and FP&A. These CFOs brought a more analytical mindset to cost control, long-term planning, and forecasting. Many came from consulting, banking, or finance functions.

Wave 3.0 (2020 to Present): Today’s CFOs are expected to drive execution. They’re taking on BizOps, RevOps, analytics, business systems, sometimes even recruiting and legal. The modern CFO is becoming a cross-functional operator, a CXO in all but title.

This evolution mirrors exactly what I’ve long believed makes a great first finance hire. I call them a "First Operator," but what I mean is: someone who doesn’t just build reports. They build clarity. They challenge assumptions. And most importantly, they take action.

It’s not enough to say, "Conversion is low." A great First Operator says, "Conversion is low, and here are three ideas we can test to improve it." They don’t just note that quota attainment is slipping. They propose a better comp model. They don’t just forecast ARR. They own the headcount plan that drives it.

The best CFOs today operate exactly the same way. They aren’t just observers of the business. They are owners.

And that has big implications.

CFOs will increasingly be expected to lead execution. Not just track metrics, but turn those metrics into decisions, projects, and results. To do that well, they need to be deeply cross-functional.

They need to understand how GTM works. How product is built. How leads get generated. How deals get done. And they need to know not just how to analyze those functions, but how to improve them.

This is where background matters. Finance leaders who have worked in early-stage startups have an advantage here. So do finance folks who have taken short tours through sales ops, marketing ops, or analytics roles. You don’t need to run the function. But you do need to be close enough to understand the mechanics and earn credibility.

The same goes for technical depth. I don’t think every CFO needs to write SQL. But they do need to understand how the data warehouse is structured. How systems talk to each other. And how to reason about architecture at a high level. If you have worked in a database before, you will be miles ahead.

Ultimately, I think CFOs will become internal product leaders. They will own the internal operating system of the company: the tools, the dashboards, the processes, the reporting, and increasingly, the systems that tie everything together.

They will be the connective tissue across every team. And more often than not, they will be responsible for making sure all the bodies are rowing in the same direction.

It’s ironic. Because for so long, finance was seen as the back office. A place for reporting and risk management. But in truth, it has always had the potential to be the operating system.

Ultimately, this is a recognition that the First Operator model works at every stage of company building.

If you are a founder making your first finance hire, look for someone who sees themselves as a business owner.

And if you are a finance leader aiming for a CFO role, go get close to the business. Sit in on pipeline reviews. Help run growth experiments. Spend a month embedded with the marketing team.

This is the future of the role. And honestly, it is already here.