How to Actually Measure Your Sales Team

From inputs to impact: how to actually measure what matters

Most founders measure sales the same way they always have: pipeline coverage, quota attainment, win rate.

Useful? Sure.

Sufficient? Not even close.

At Intercom, I was the first person to really dig into sales performance from a metrics and systems perspective. Until then, we’d been growing fast through a thriving self-serve motion. Sales was relatively new. We were building a team from scratch. The company had hired some great reps, but no one was measuring anything.

So I did.

I started hooking things together. I think the first thing I built was an API script that pulled from Pipedrive (our short lived CRM) 🤣 . But it took me years (and eventually working with great people like Chris Burgner) to learn what really matters when it comes to measuring sales team.

Since then, I’ve worked with sales teams at every stage, from scrappy $1M ARR startups to $150M+ machines. At Equals, we rebuilt our go-to-market from the ground up. We started product-led. Today, we’re sales-led. And in both cases, the lesson’s been the same:

If you only measure sales using lagging indicators, you're already too late.

Founders tend to treat sales like a scoreboard. But great sales teams aren’t built by cheering on the numbers after the game ends. They’re built by understanding what creates those numbers in the first place, and then improving that engine over time.

Sales is a system.

And systems need to be measured across inputs, process, and outputs.

The Problem with Only Measuring Output

Here’s the first trap: managing sales purely on output. Bookings and quota attainment might tell you what happened, but not why. They don’t show you what levers to pull, what bets are working, or where your team is stuck.

Imagine judging your marketing team without looking at ad spend, conversion rates, or engagement. Sounds crazy, right? Yet many teams still evaluate sales purely on revenue.

Sales is a system and systems have inputs, processes, and outputs. If you only measure the end result, you miss the entire mechanism that creates it.

Inputs: The Metrics You Can Actually Influence

The beauty of input metrics is that they’re controllable. You can’t will a deal to close, but you can certainly drive the actions that help book more meetings.

At Equals, we track daily and weekly activities like:

Outbound touches per day

Meetings booked per week

Email engagement rates (opens, replies, click-throughs)

This isn’t about micromanagement, it’s about visibility. When one rep is consistently booking 10 demos a week and another is stuck at 3, we don’t need a forecast to tell us who’s falling behind. Pattern recognition starts with inputs. And without this baseline, you’re managing by gut feel, chalking up misses to “macro headwinds” or “bad luck.”

Process Metrics: The Hidden Engine of Sales Effectiveness

This is where most teams go blind. You can have all the activity in the world, but if your process is broken, or just opaque, you won’t know why deals are slipping.

Every deal moves through a journey. If you’re not analyzing stage-to-stage conversion, time stuck in each stage, or forecast volatility, then you’re not really learning.

We track:

Stage conversion rates by rep and segment

Time in stage (especially proposal and legal)

Win rates by stage and deal type

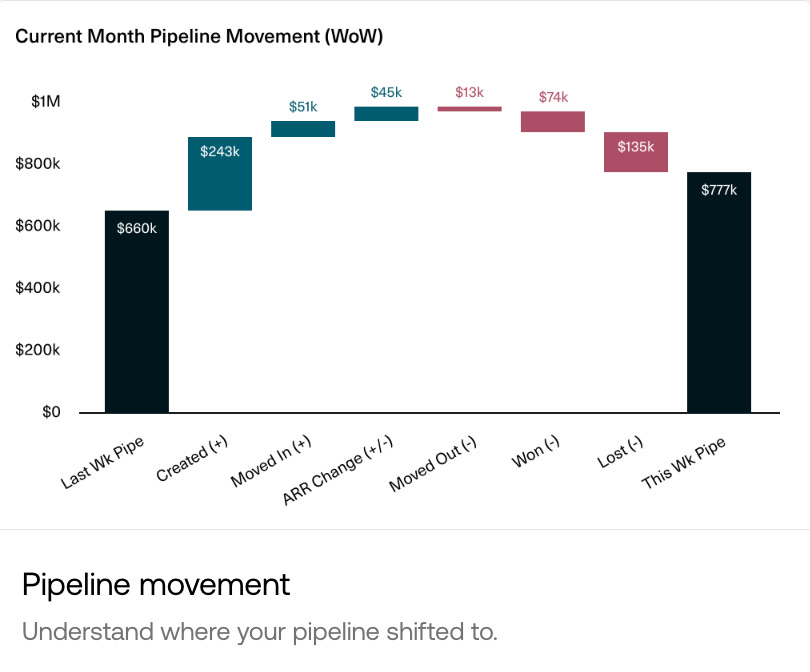

Changes to pipeline over time… e.g. the pipe diff

One of our most valuable tools is deal lifecycle reporting—not just where deals are today, but how they got there. We want to know what changed period over period in our pipeline. This lets us quickly dissect and understand longitudinally (through a month or quarter) how our pipeline is evolving. It looks something like this:

Outputs: Still Necessary, But Never Alone

Of course outputs matter. Quota attainment, bookings, pipe coverage—these are the headlines.

But without the story underneath, they’re misleading.

We contextualize output with:

Bookings vs. forecast

Forecast variance from prior weeks/months

% of pipe created and closed within the same quarter

Net new pipeline generated

And here’s a question we ask constantly:

Are we mortgaging next quarter to hit this one?

If you’re pulling in deals to hit your number but failing to generate new pipeline, your forecast may look fine today—but you’ve already lost tomorrow.

Sales vs. Finance: Different Truths, Same Reality

One of the biggest disconnects in any org is between Sales and Finance. The CRO says we’re pacing to crush it. The CFO says we’re behind. Who’s right?

It depends.

It could be that sales is looking at bookings. Finance is looking at revenue and cash. The difference is timing, and that matters.

To resolve this tension, you need shared definitions. Define what pipeline means. Align on what qualifies as “commit.” Build views that make sense to both teams.

Otherwise, you’ll waste hours every month in pipeline review meetings arguing about numbers instead of understanding the story they’re telling.

It could also be that the teams have fundamentally different approaches to forecasts. A Sales leader will oftentimes use a forecast as a way to challenge the team, commit, and drive urgency at the end of a quarter. They’ll be overly aggressive. And a finance person hates missing a number, so they’ll sandbag and tend to be too pessimistic. The answer is often in the middle.

Final Thought

Don’t run sales like a scoreboard. Run it like a system.

If you only measure what closes, you’ll always be reacting.

If you measure inputs and process, you’ll start predicting—and improving.

That’s how you go from celebrating wins to actually engineering them.

Hey Bobby, great article. I’m curious if you have any recommendations on how to forecast pipeline created? We’re currently planning for Q3, and my sales leader is telling me we have no way to project pipeline created.